Printable 1099-MISC Form

Fill Out 1099 Form Online for Free

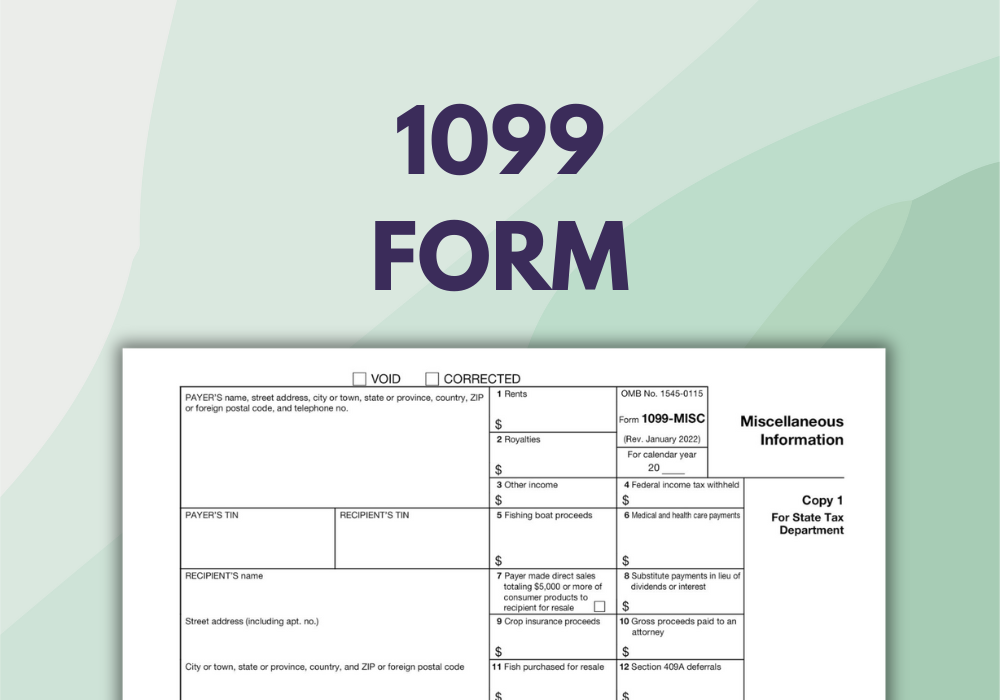

Get FormManaging taxes can be a complex task, but with the right guidance and tools, it becomes significantly easier. If you're an independent contractor or have carried out freelance work, you might be familiar with Form 1099-MISC. This document is crucial for reporting any payments you've received to the Internal Revenue Service (IRS) during the tax year. Let's break down this form's layout, ensuring you can navigate it confidently.

Generally, the 1099 form printable template includes several important sections. At the top, you must provide the payer's information, which includes their name, address, and tax ID number. Next, you enter your own name, address, and Social Security or tax ID number as the recipient of the payments. Below this, the form has numbered boxes where you'll input the total amounts paid to you in the course of the year, specifying the type of income, whether it's rents, royalties, or non-employee compensation.

Checklist for IRS Form 1099 Accurate Completion

- Verify that the payer's and your personal information is correct.

- Cross-check the amounts entered against your records to ensure accuracy.

- Use the boxes on the form to report specific types of payments appropriately.

- Double-check your Social Security or tax ID number for any errors.

- Review the form for any blank spaces containing necessary information.

Guide to Filing the 1099-MISC Form

Once your printable Form 1099-MISC for 2023 is filled out correctly, the next step is to file it. Here's a simple-to-follow process:

- Download the free printable 1099 tax form from our finance website.

- Print the form using a printer with adequate ink to ensure all information is legible.

- Complete the form using a blue or black pen, or type out the information if your handwriting is difficult to read.

- Make a copy of the completed 1099-MISC for your records before mailing it out.

- Mail the original completed form to the IRS and send a copy to the individual or entity from whom you received payment.

- If required, also remit a copy to your state tax department according to your state's filing guidelines.

Filing Deadline for the 1099-MISC Tax Form

It's crucial not to miss the filing deadline for the 1099-MISC printable form. For the 2023 tax season, the form must be sent to the IRS by January 31, 2024, if you report non-employee compensation. This is the same date that copies of the form must be delivered to any individuals or businesses for whom you report payments.

Postmarking your forms by this date is sufficient, but it's always better to mail them early to account for potential delays. If you must also file with your state, remember that the state deadlines can vary, so double-check with your state's tax authority.

Remember that you can always find a printable 1099 form for free on our website. With these directions and the proper forms, you'll be set to navigate tax season with confidence and ease.