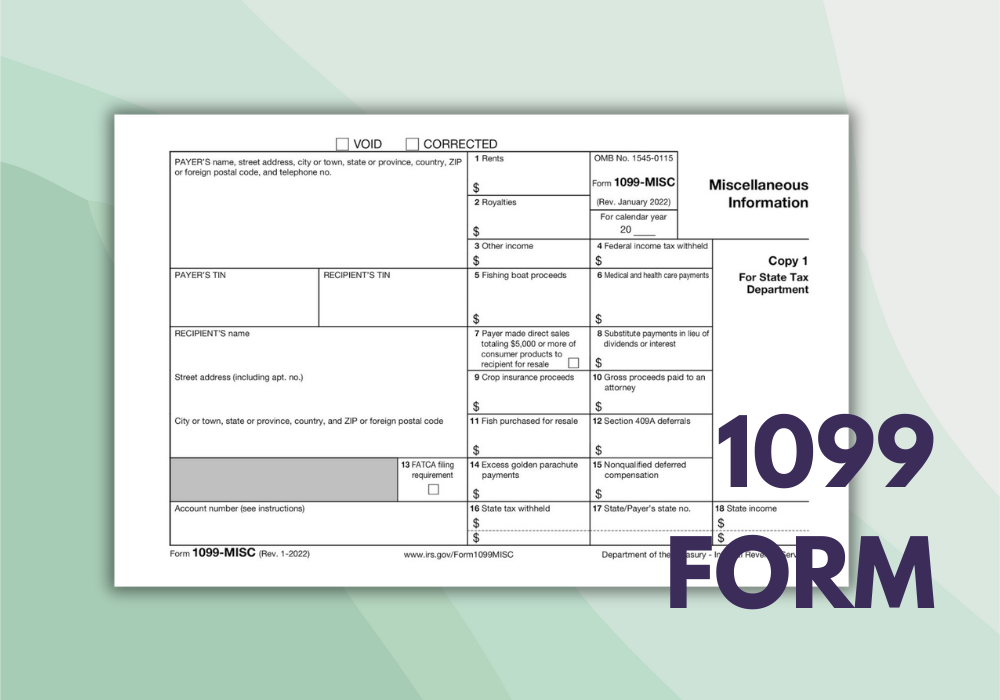

1099-MISC Template in PDF

Fill Out 1099 Form Online for Free

Get FormWhen the tax season arrives, the term '1099-MISC' becomes crucial for many individuals, especially freelancers or independent contractors. The 1099-MISC tax form is a document that businesses use to report various types of income paid to individuals:

- rent,

- royalties,

- prizes,

- awards.

If a person or business provided you with certain types of income, they might send you a 1099 tax form in PDF, which you need to include with your tax return.

Updates to the 1099-MISC Tax Form (PDF)

In recent years, there have been changes to tax documents, including the 1099-MISC form. It's important to keep up-to-date with these changes to ensure accurate tax filings. The specifics can involve modifications in the reporting requirements or the introduction of new forms, such as the 1099-NEC, which now covers non-employee compensation previously reported in box 7 of the 1099-MISC form. Staying informed about these alterations can help prevent mistakes when reporting your taxes.

Who Should Receive Form 1099-MISC?

Determining who is eligible to use the blank 1099-MISC form in PDF is essential for proper tax compliance. Generally, this form should be sent to any individual, partnership, or estate you have paid at least $600 in rent, services, prizes, or other income payments during the tax year. However, payments for personal purposes do not require this form. Furthermore, corporate payments typically do not mandate a 1099-MISC, except in certain circumstances like medical, healthcare, and fishing activities.

Comparing Different IRS 1099 Forms

| Form Type | Primary Use |

|---|---|

| 1099-INT | Used to report interest income, such as interest from bank accounts or investments. |

| 1099-MISC | Reports various forms of income, such as rent, royalties, and non-employee awards. |

| 1099-NEC | Specifically for reporting non-employee compensation, such as contractor payments. |

Accessing the Blank 1099 Form in PDF

It's essential to use the correct year's form, such as the printable 1099 form for 2023 in PDF, to avoid any confusion or errors in your tax submission. Luckily, by following the link from our website, you can access the relevant document for free and complete it in any way you like.

For those who need to furnish several forms, a free blank 1099 form in PDF format can be quite convenient. This template helps streamline the process of filling out the form and ensures consistency across multiple submissions. Remember to verify with the IRS or a tax professional to ensure you have the most current version of the template and any other forms you might need.

With organizational tools like the 1099-MISC template in PDF and a clear understanding of the reporting requirements for different types of income, handling your tax obligations can be significantly simpler. Keep all your income information organized, stay aware of any changes to tax reporting laws, and when in doubt, consult a tax professional for guidance to achieve a stress-free tax filing experience.